Photography Business Tax Write Offs

/Aside from the obvious write-off being camera gear, here are some less common tax write offs for your photography business:

🚙 Mileage. I use the Quickbooks Self Employed app which tracks my mileage in the background when I go to shoots.

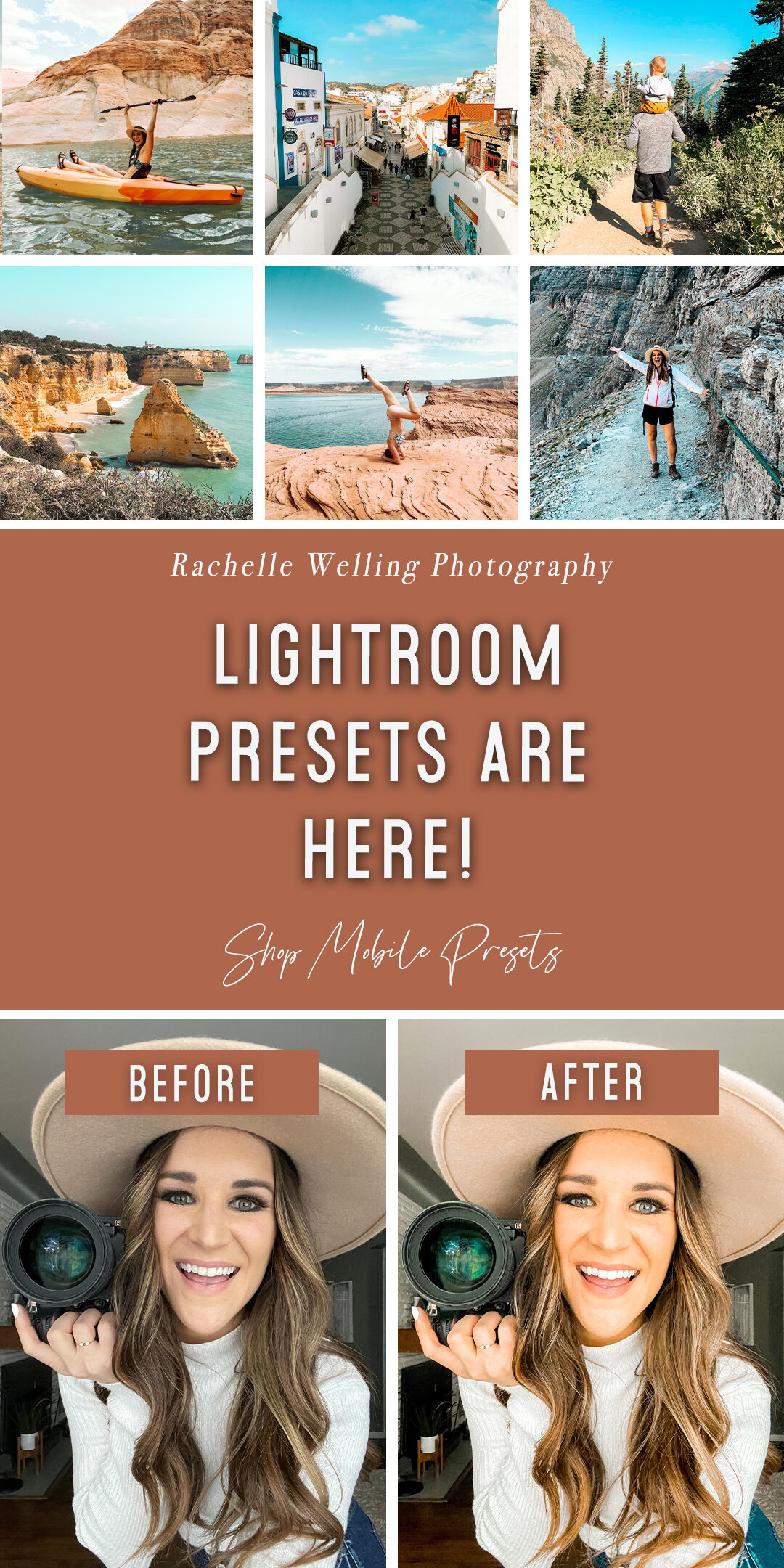

👩🏻💻 Editing software. I pay for the Adobe Photography plan which includes Lightroom and Photoshop. Also write off any presets you purchased.

☁️ Data storage. I use PicTime to store and deliver client galleries. I also write off external hard drives and memory cards.

🖥 Online advertising. Google, Facebook, Instagram. Wherever you run ads, write it off.

📷 Business insurance. I use Hartford for business, gear and liability insurance.

📱 Phone & internet. The latest iPhone that you use to run your business from the road? Write it off.

📚 Conferences, classes, mentor sessions. Any courses you take for your business, you know the drill.

For legal reasons, this is not professional advice. Consult your CPA. I’m not a tax pro. I just take photos. ✌🏼